“When I grow up, I’ll own my own business and have plenty of money.” This statement was a childhood dream for many. It implied that there’d be no boss to answer to, work flexibility, and potentially unlimited income. What these childhood ambitions failed to realise is that entrepreneurship is not a walk in the park. While there is some level of financial consistency when the business is fully established, in its early stages, cash flow is somewhat of a struggle, and the question of how to pay yourself as a business owner needs to be answered.

In this article, we will go over some of the things to consider before paying yourself a salary as a business owner.

- Before paying yourself a monthly salary, ensure that your business finances are in order.

As a small business owner, your main priority should be keeping your business afloat. Your business is a separate entity from you, and so it should be able to stand without your support. When your business can achieve this level of financial independence, you can then consider taking out a consistent amount of money to pay yourself monthly.

Additionally, it aids in business projection. Once you have a clear understanding of how your revenue and expenses compare, you can start to make more informed business decisions.

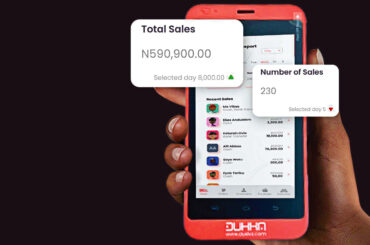

If you have consistently recorded your sales and expenses on the Dukka app, the in-built business analysis report will give you a clear idea of how well your business is doing each month. Armed with this information, you are well on your way to knowing how much you can set aside as a monthly salary.

- Take your efforts for your business into consideration.

You should consider yourself an employee of the business in the same way your other staff members are. Like any other employee, your salary is dependent on the amount of work you do for the business. When considering what to pay yourself, do not underestimate the amount of effort and time you have put into making the business what it has become. If you are a solo entrepreneur, you are doing a lot, and your monthly salary should reflect that.

Now, you need to draw a balance between your estimation of your effort and the amount of revenue your business is generating. This will help you decide a reasonable amount to pay yourself.

- Properly apportion your profit

Your business analysis report on the Dukka app helps you to understand your current financial position. You have a clear idea of your revenue and your profit. This understanding helps you to calculate just how much of your profit you can pay yourself as a monthly salary.

Before you take out your salary from your business profit, there are other expenses you must consider. They include

- Emergency fund: 20% of your business profit should be saved up monthly as an accessible emergency fund. This would come in handy on rainy days when you need immediate cash to fund your business.

- Taxes: 30% of your total profit should be set aside for tax purposes. While in reality, you may not need to pay this much in taxes, it is advised that you have enough money set aside in case of any future tax regulations.

- Reinvestment fund. 20% of your profit should be reinvested into your business. This will help to finance expansion plans or new projects you need to embark on to help grow your business.

- Salary: 30% of your business profit should be set aside as your monthly salary.

In conclusion:

During the first few years of operating a business, it’s common for a business owner to go unpaid. Whether or not you choose to pay yourself is entirely up to you, but remember that your time and effort are valuable. You are the most important member of staff. If you don’t currently pay yourself, you should plan to do so as your business expands and achieves new profit milestones.

……………………………………………………………………………………………………………………………………………………………

About Dukka

Dukka is a leading bookkeeping and payments app. We provide solutions for bookkeeping, payments, cash flow management, and access to finance for small businesses in Africa. We are building an OS for commerce for African merchants.

To learn more about what Dukka is doing or to have a general chat, visit Dukka.com.