As a small business owner, your role is more than just administrative management. You have to wear a lot of hats, and the role of a financial manager is one of them. That is where invoices come in.

In plain words, an invoice is a document that regulates business relations between a buyer and a seller. It shows what services or goods a vendor will sell to a buyer and how much they will cost. It also includes payment terms and other important information we will dwell upon later in this article.

In this article, we will walk you through some ways that processing invoices can help your business.

- They keep customers happy.

You may not know that invoicing is part of good customer service, but it is. Offering invoice payments enables your customers to pay you after you have issued a product or service.

This is convenient for you as well as regular and returning customers. Giving them the option to pay you when it suits them, within reason, is a great way to keep customers happy.

Secondly, invoice processing is not just for you. Customers also need to keep track of their finances. An invoice detailing what was purchased, time of purchase, and if there are late fees can be beneficial.

- They give your business a professional outlook.

A professional invoice has more of an impact on customer experience than you realise. When you issue a customer an invoice, you are showing them that your small business runs on efficient processes. That helps them trust you.

A professional invoice containing all the necessary information on a well-designed template also helps you stand out from competitors. An invoice is a touchpoint with a customer, which means it is an opportunity for you to offer a top-notch experience. Their customer journey with you should be flawless from start to finish.

- They keep you organised.

This seems obvious, but keeping an organised record of your invoices is vital. It will help you keep an eye on all your payments, pending or otherwise, so you know where you stand financially.

- They help you to get paid on time.

There are a few reasons invoices help a business to get paid faster. A well-written invoice will have the following information:

- An invoice number and date of issue

- Your company name and address

- Your company contact details

- Details of the product or service

- The amount due and

- Payment information, including how to pay

- An overdue fee

If the customer has all that, they have everything they need to pay you. A due date will help to apply some pressure if required, and if you add an overdue fee to your invoice, this could help even more.

Your customers will sometimes have questions, and by having all of your contact information readily available and an overview of what they need to pay, you are helping them and yourself.

- Things have gotten easier with invoice systems for small businesses

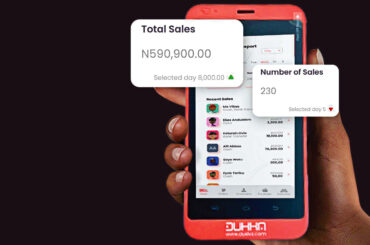

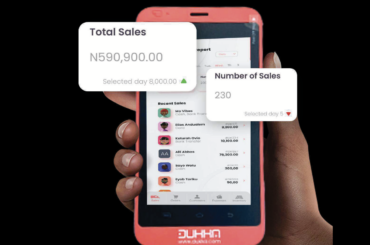

Luckily, technology companies have recognised the importance of automated invoice processing, and as a result, we have seen an increasing number of online and in-app invoicing solutions. This means that business owners can send invoices to customers in seconds.

This is also an easier way to store and keep track of your invoices without stacks of paperwork or filing cabinets. Dukka is accessible, efficient, and fast if you are looking for a simple solution.

Are you a small business owner looking for tips and tricks to make day-to-day administration easier? We are here to help. For more articles, check out the Dukka blog.