‘Madam, you get POS? Or I fit do transfer? I no carry plenty cash come.’

How often have you found yourself in this situation as the customer or owner of the business? If you have been the business owner in this instance, your answer to this question should never have been no. If your business is not yet accepting digital payments, you might just be leaving a lot of money on the table.

Here are five reasons why you should expand your payment options.

- You will attract more customers.

Customers love convenience. Customers hate carrying cash around. If patronizing your business saves them the stress of queuing at the ATM to withdraw some money, you’ve won them for life. Accepting bank transfers and card payments via POS terminals gives customers a more effortless shopping experience. Also, they are more likely to recommend your business to their friends, who hate to pay with cash.

2. You will build a sense of trust in your customers

Accepting card payments validates your business legitimacy. Every customer knows that owning a POS terminal verifies that you have a working relationship with a bank. That instils trust in their hearts because they know on multiple levels that you are traceable if anything goes wrong.

3. Card-paying customers tend to spend more money

A lot of people are impulse buyers. They tend to curb their spending when limited by cash-in-hand. You will then lose the extra sales you could have made from such customers by accepting card payments. Your ability to take multiple forms of digital payments – card and bank transfer – encourages customers to make larger purchases even when they don’t have physical cash.

4. Your bookkeeping process is simplified

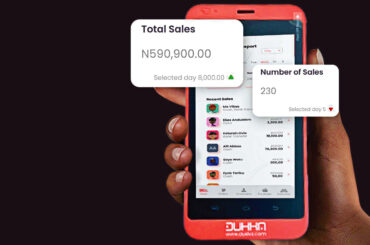

It is hard to attend to a lot of customers at once and still be able to record sales. This is especially true when the customers are paying you via physical cash. With card payments, you and the customer are forced to use a POS terminal to conclude the transaction. This digital payment auto generates an electronic transaction record for you, making it easy for you to track your daily, weekly, and monthly income. Such reports equip you with information to make informed and data-driven decisions regarding your business.

5. You don’t have to spend much—and it’s simple to get started

Running on a shoestring budget? Can’t afford the high cost of acquiring a POS terminal? No worries, Dukka’s got you. For as low as N3,500 per month, you can own a Dukka POS terminal. Owning a POS terminal to start accepting card payments has never been easier.

Accept Digital payments with Dukka’s Android POS

At Dukka, we firmly believe that every business should have the means to accept payments anytime, anywhere, and anyhow customers choose to pay. Set yourself apart from your peers, and give your business the leg it needs. To get started, sign up here.