For business owners, bookkeeping can often be seen as a tedious task, yet it is the backbone of any successful business. Bookkeeping involves recording your financial transactions, maintaining accurate records in your business, and providing essential data for decision-making. While Dukka simplifies this process significantly, understanding the best practices of bookkeeping can help you maximise its benefits.

Here are some of the best practices:

- Timeliness is Key

Do not keep till later. Recording transactions promptly is very crucial. Delayed entries can often lead to inaccuracies and make it difficult to track cash flow. When you use the Dukka app, transactions are very easy to input as they occur. Set reminders or notifications to ensure you stay on top of your bookkeeping.

- Categorization Matters

Categorising your transactions correctly is also essential for accurate financial reporting. Dukka offers various categories to help you classify your income and expenses effectively. Consistent categorization will provide valuable insights into your business’s financial health.

- Reconcile Regularly

Regularly reconciling your bank accounts with your bookkeeping records is a vital step. This process helps identify discrepancies, prevent errors, and maintain the integrity of your financial data.

- Backup Your Data

Data loss can be catastrophic for any business. Using the Dukka app provides you with an automatic backups, however it’s still essential to have additional safeguards. Consider backing up your data regularly to an external hard drive or cloud storage service.

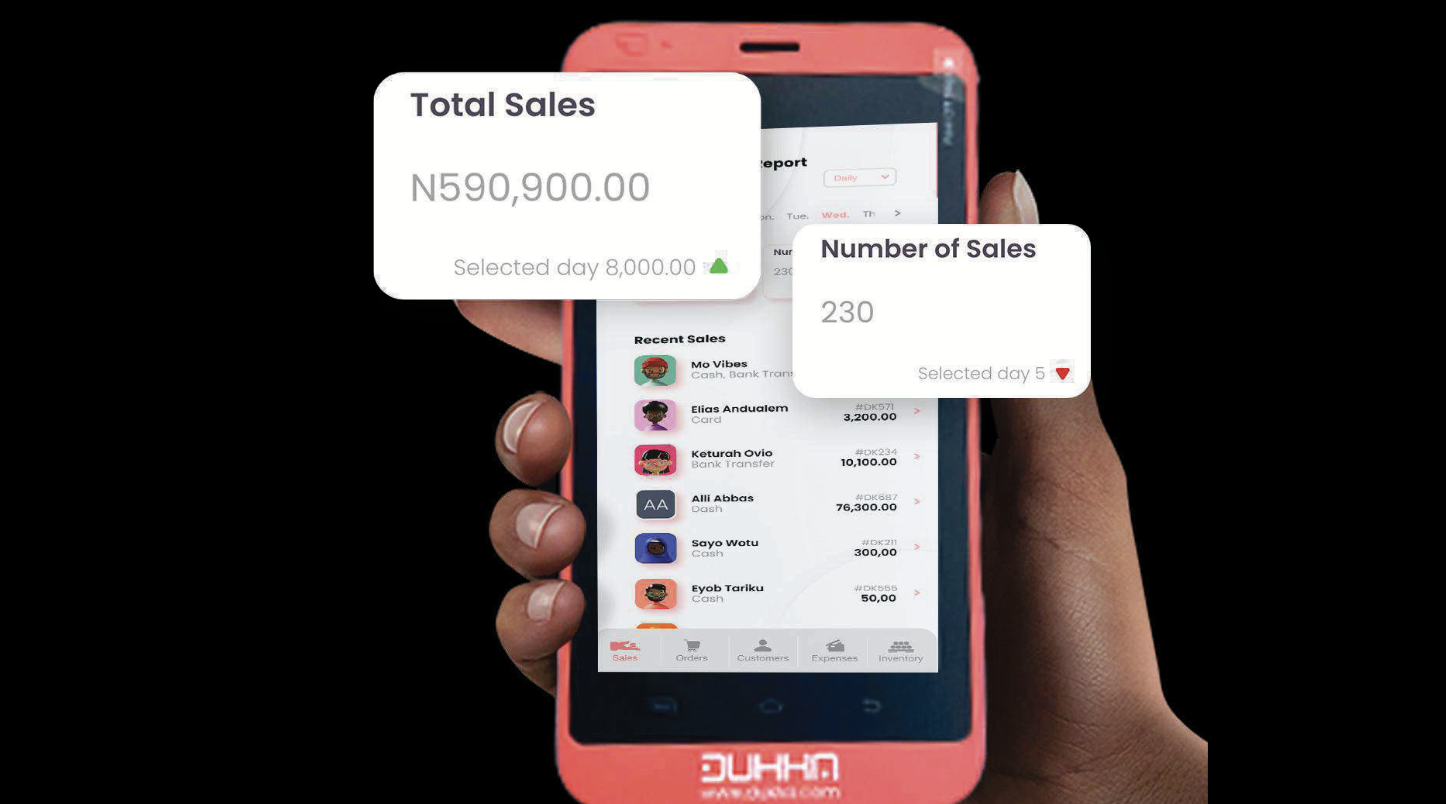

- Utilize Reports and Insights

Dukka offers a range of reports to help you analyze your financial performance. Take advantage of these tools to track income, expenses, profit margins, and other key metrics. Understanding your financial data empowers you to make informed decisions.

- Stay Updated with Tax Laws

Tax laws can be complex and subject to change. Stay informed about the latest tax regulations to ensure compliance. Dukka can help you categorize expenses for tax purposes, but it’s essential to consult with a tax professional for personalized advice.

By following these best practices and leveraging Dukka’s features, you can streamline your bookkeeping process, improve financial accuracy, and gain valuable insights to drive your business forward. Remember, consistent and diligent bookkeeping is the foundation for sound financial management.

Download the Dukka app for ios or for android today and see the difference exceptional customer service can make in your Nigerian business!